Get an ASB loan at interest rates as low as 36. Deposit Interest Rate in China remained unchanged at 035 percent in June from 035 percent in May of 2022.

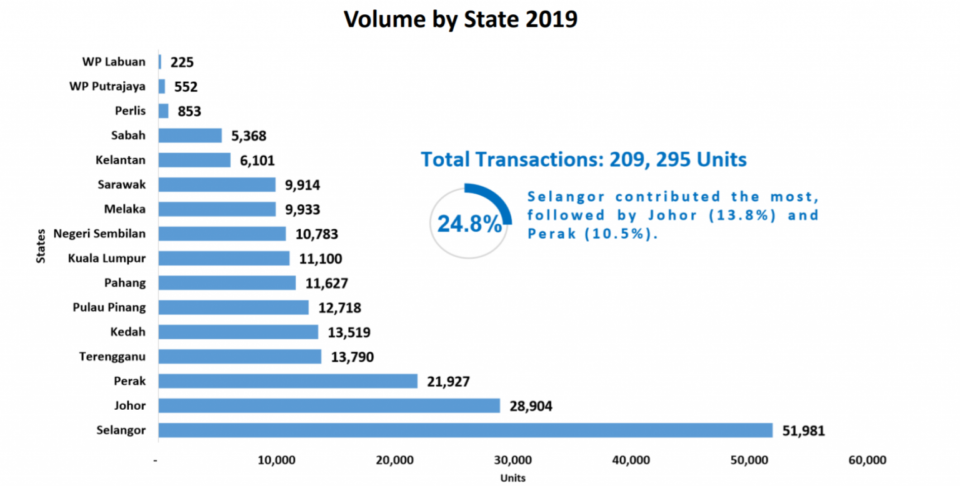

9 Key Takeaways From Napic Real Estate Malaysia Market Report 2019

The board decided to revised upwards its inflation forecast to 67 percent for FY 2022-2023 from 57 percent.

. The interest rates will depend on the banks. So its better to talk to your existing bank before going with a personal loan. Zero interest-rate policy ZIRP is a macroeconomic concept describing conditions with a very low nominal interest rate such as those in contemporary Japan and in the United States from December 2008 through December 2015.

English BM Loans. The Reserve Bank of India raised its key repo rate by 50 bps to 49 during its June meeting after Mays surprise 40 bps off-cycle hike surprising markets had forecast a 40 bps rate hike aiming to ensure inflation remains within target going forward while supporting growth. Well I guess you can try to get a top-up home loan or personal loan from the bank to cover the Memorandum of Transfer MOT cost.

ZIRP is considered to be an unconventional monetary policy instrument and can be associated with slow economic growth deflation and deleverage. If you want to see a real example here you go. If you earn more than RM34000 a year youre not going to escape paying your taxes but what you can do is try to get them back in your tax refund.

Lets say you purchased a house 12 years ago for RM500000 now you want to sell it. This rates is effective from 1st January 2019 to 30th June 2019. Deposit Interest Rate in China averaged 106 percent from 1990 until 2022 reaching an all time high of 315 percent in July of 1993 and a record low of 035 percent in July of 2012.

Tax payable RPGT Rate based on holding period Net Chargeable Gain. This page includes a chart with historical data for Deposit Interest Rate in China. Typically home loan interest rates will be much lower than a personal loan.

Despite widespread legal housing discrimination in the 1950s the number of black households that owned their own homes increased 20 from 1950 to 1970 but somehow the black homeownership rate. Instead of inaction Sarawak Premier. Compare the best ASB loan options in Malaysia.

ASB Financing Inclusive of GRTT GRTA. If you are filing your taxes in 2021 for YA 2020 then head on over to our new article on everything you should claim here. If youd like a simpler way to compute your RPGT why not check out this handy calculator which will save you the hassle.

In 2019 after the Pakatan Harapan PH government did not allocate any funding for affordable housing for Sarawak despite housing being a concurrent list. This article pertains to income tax filing for the year of assessment 2019.

Bnm Prices Of Homes Not Expected To Fall Significantly As First Time Homebuyers Demand Still Strong Malay Mail

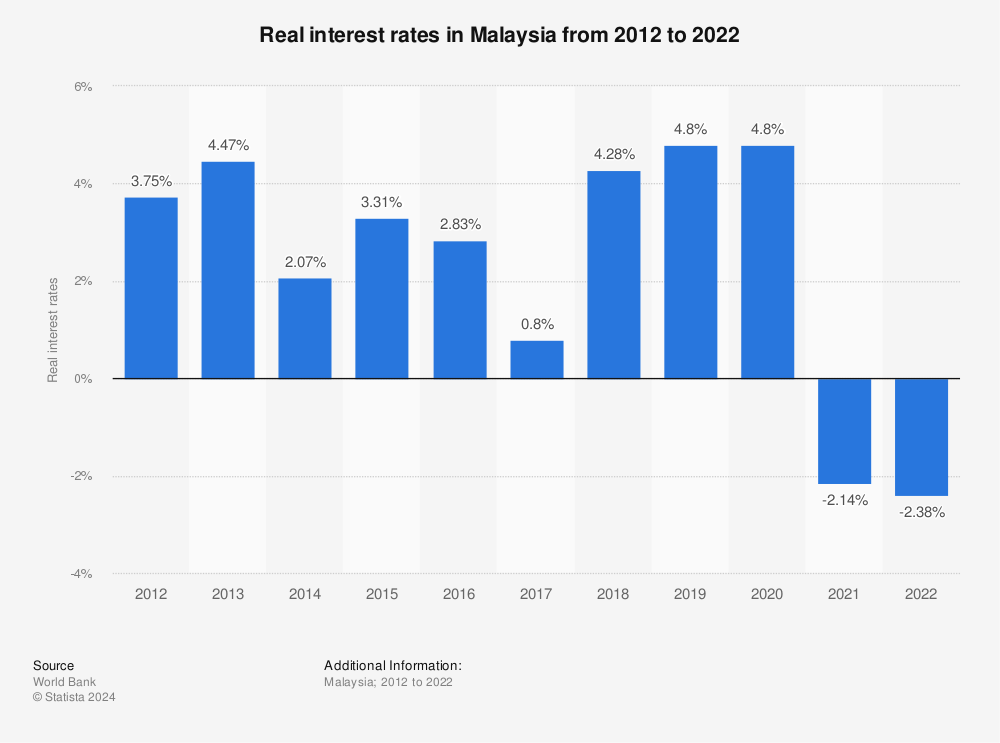

Malaysia Real Interest Rates 2020 Statista

Elevated Level Of Household Debt Alarming Amid Weak Economy The Edge Markets

Malaysia Economic Growth Data Chart Theglobaleconomy Com

9 Key Takeaways From Napic Real Estate Malaysia Market Report 2019

Special Report Gleaning Insights From The 2019 Household Income Survey The Edge Markets

What Ails The Malaysian Residential Property Sector The Edge Markets

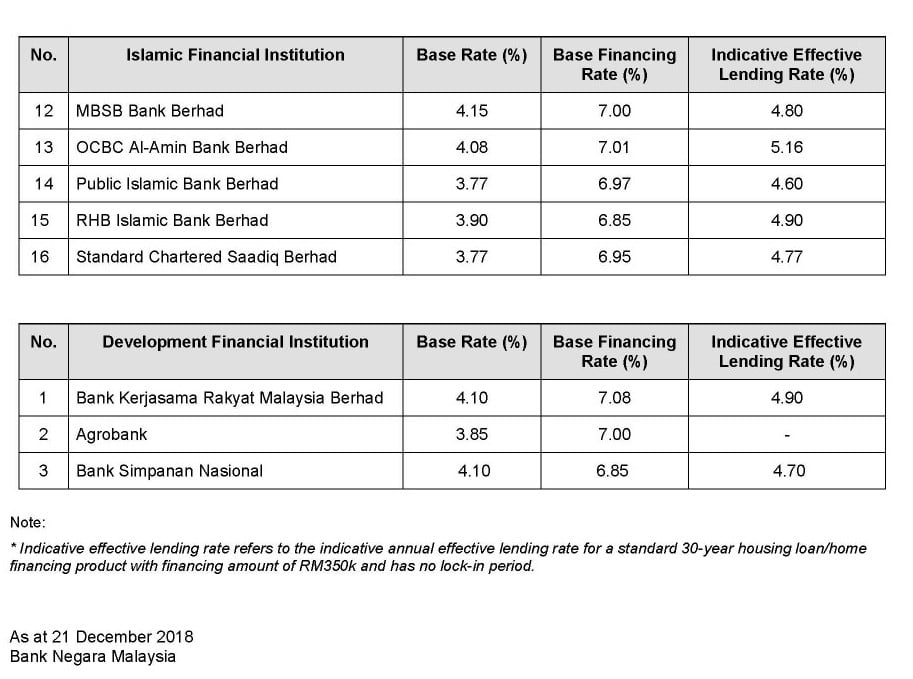

2019 Bank Mortgage Interest Rates Malaysia

Australia Imports From Malaysia 2022 Data 2023 Forecast 1988 2021 Historical

Banks Interest Rate After Bnm S 2019 Opr Cut

Finance Malaysia Blogspot What Is The Lending Rate From Various Banks Now Updated May 2019

The Latest Base Rate Br Base Lending Rate Blr And Base Financing Rate Bfr As At 21st December 2018 Malaysia Housing Loan

Malaysia Lending Interest Rate Data Chart Theglobaleconomy Com

Malaysia House Prices Growth Economic Indicators Ceic

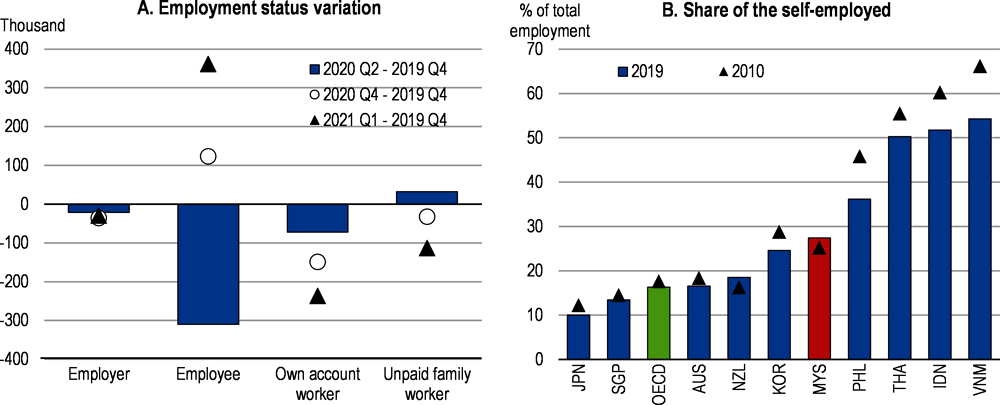

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

9 Key Takeaways From Napic Real Estate Malaysia Market Report 2019

Banks Interest Rate After Bnm S 2019 Opr Cut

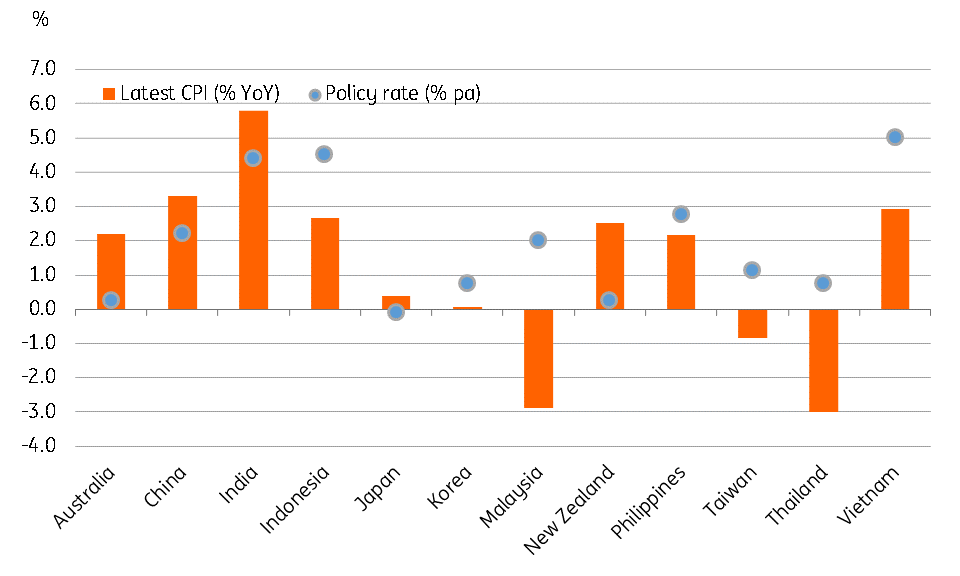

Malaysia Falling Prices Call For More Interest Rate Cuts Article Ing Think

Asb Loan A Comparison Of All Asb Loan Options In Malaysia